Summary

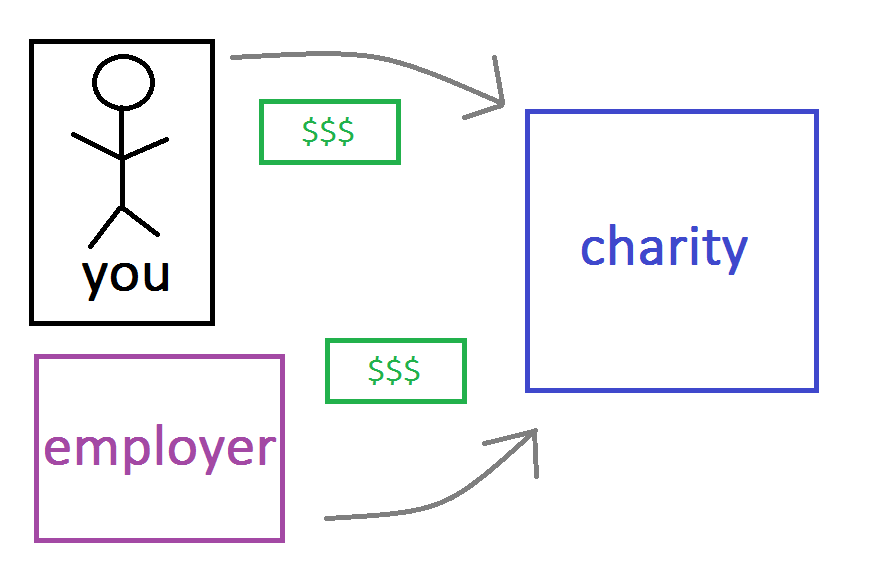

Many companies offer "matching donations" programs in which employees can request employers to match personal charitable donations up to some annual limit. This page compiles the biggest matching limits that I've come across.

Contents

Introduction

This essay focuses on huge employer-matching limits (ignoring those ~$60K or lower). Employers are listed in descending order of annual match limits. This list is targeted toward readers in the USA, but some employers match internationally. Let me know if you have corrections or additions.

This essay focuses on huge employer-matching limits (ignoring those ~$60K or lower). Employers are listed in descending order of annual match limits. This list is targeted toward readers in the USA, but some employers match internationally. Let me know if you have corrections or additions.

Many of these employers hire software developers, finance/accounting/business people, lawyers, and other specialists outside their core areas of focus, so you might be able to work at one of these places even if you don't have expertise in hedge funds, actuarial work, foundation grants, or mining.

Before expending significant effort trying to work at one of these organizations, contact one or two people who work at the company (via shared contacts on LinkedIn) to verify the accuracy of this information. If you do so, feel free to let me know what you find out.

Keep in mind that if you work for a foundation, the donation matches come out of foundation funds and so aren't donated to the foundation's own projects. How much this matters depends on how valuable you think the foundation's work is. This leads to the unfortunate situation that it's better in terms of donation matching to work at a foundation whose work you think is less valuable. On the other hand, the direct impact of your employment increases in proportion to how valuable the foundation's work is, assuming you're a productive worker. (It's not obvious which effect is stronger. For instance, suppose you do your job ~10% better than the person who would have been hired in your place, while your pay after costs of living is ~10% of your value to the organization. Then the cost in terms of taking matching dollars away from where the foundation would have donated is roughly comparable to the extra benefit that you give the organization through your direct work.)

$300K/year: Soros Fund Management

Soros Fund Management matches at a 3:1 ratio up to $100K per year. See this page for further info.

$200K/year: Arch Insurance Group

This page gives some info about Arch's matches, but it doesn't specify the matching limit. From someone who works at Arch, I confirmed in 2015 that the annual matching limit per employee is $200K. I don't know if the matching program is only for Arch Insurance Group or for all members of Arch Capital Group.

According to the application form for matching gifts:

Arch operates a 1:1 matching gift program for certain gifts by Arch employees. To qualify for a matching gift, your organization must be recognized by the IRS as an organization described in Section 501(c)(3) of the Internal Revenue Code that is eligible to receive tax deductible contributions under Section 170(a) of the Internal Revenue Code, and as a public charity and not a private foundation within the meaning of Section 509(a) of the Internal Revenue Code.

More info on the company:

- LinkedIn page (501-1000 employees)

- Yahoo Finance page for parent company, Arch Capital Group (1,920 employees)

- Glassdoor salaries

- official careers website

Because the company has more employees than Soros Fund Management and is probably less elite, it's likely easier to get hired at Arch than Soros. On the other hand, you might not earn $200K/year at Arch, so your ability to take advantage of the whole match amount isn't clear, at least until you got a very senior role at the company.

The kinds of jobs available include actuarial, software, IT, finance, legal, marketing, etc.

$200K/year: W. K. Kellogg Foundation

The foundation focuses on anti-poverty work, mostly in the USA. Its three goals are Educated Kids, Healthy Kids, and Secure Families.

According to the Foundation Directory Online:

The foundation matches gifts of all full-time employees, officers, trustees, and retired employees to eligible organizations having status as a public institution under Section 501(c)(3) and 509(a) of the Internal Revenue Code and foreign charitable organizations determined equivalent to a U.S. Section 501(c)(3) and 509(a) organization. This includes schools, government units, hospital or medical research facilities, religious organizations, and public-supported charities. Only direct gifts of cash or marketable securities to the charity by an eligible donor will be matched. The minimum gift is $25 and the maximum is $100,000 per eligible donor per calendar year. The maximum total corporate payout per employee, per year is $200,000. Gifts are matched on a two-to-one ratio.

Interestingly, the above passage mentions "retired employees". I assume that means employees who are actually retired rather than who have just moved on to a new job? If you have enough income to donate large amounts in retirement, the ability to match even in retirement could be a big deal. That said, unless you're close to retirement age already, it seems rather unlikely the matching program will still be around and offer retirement matching when you retire several decades from now. Also, if you donate to non-poverty-related causes, people might look down upon you for redirecting the foundation's money away from needy children in the USA.

More info:

- LinkedIn page (201-500 employees)

- Wikipedia page

- Glassdoor salaries

- official careers website

Pay seems quite high for a nonprofit.

$100K/year: BHP Billiton

The company matches gifts at a 2:1 ratio up to a limit of USD$100K matched. Many charity types are eligible, though some aren't (see sec. 5). A few charities like Greenpeace and Amnesty International either don't qualify or don't accept matched donations from the company. (I don't know the backstory, but probably things like this have to do with it: "Environment & Human Rights groups condemn BHP Billiton in Colombia".) BHP Billiton's document doesn't explicitly say that most 501c3s are eligible, though sec. 6.3 does say that "501(c)(3) organisations or organisations with Deductible Gift Recipient (DGR) status only need to provide proof of this and correct banking details for validation."

More info:

- Double the Donation page

- LinkedIn page (10,000+ employees)

- Wikipedia page

- Glassdoor salaries

- official careers website

Since the company does mining and petroleum, many of the jobs involve engineering, geology, and other on-site technical work, but there are also regular corporate jobs, like finance and accounting.

$90K/year: Rockefeller Foundation

Whereas W. K. Kellogg focused mostly on poverty in the USA, Rockefeller focuses a lot on international poverty.

According to "The Rockefeller Foundation Matching Gift Program Rules and Procedures":

The Rockefeller Foundation offers a generous matching gift program to encourage its staff, trustees and finance committee members to make personal donations to the charities of their choice. The Foundation will match donations on a 3:1 basis, up to $90,000 per individual per calendar year (matching a total of up to $30,000 employee funds per year of contributions made by an eligible trustee or staff participant).

Matching is available to both full-time and part-time staff. Donations must come from your own personal assets (or joint assets with a spouse / domestic partner), not from fundraising events or from other people trying to get their donations matched. If you give from a donor-advised fund (DAF), you have to put into the DAF in the same year at least as much as you grant out of it for matching (or, at least, this is my best interpretation of what the guidelines say).

The FAQs about the matching program include explanation of which charities are eligible (all 501c3 public charities, plus possibly others; see p. 2) and how to determine if a charity is eligible (see p. 3).

More info:

- Double the Donation page

- LinkedIn page (51-200 employees)

- Wikipedia page

- Glassdoor salaries

- official careers website

Pay is quite high for a nonprofit.

$90K/year: Ford Foundation

The Ford Foundation’s Matching Gift Program guidelines explain:

All full-time and part-time Foundation employees and all members of the Foundation’s Board of Trustees are eligible to submit up to a total of $30,000 in contributions for a Foundation match in any calendar year. The Foundation will match eligible contributions 3-for-1.

501(c)(3) public charities "(other than a Type III supporting organization)", governmental units, tax-exempt religious organizations, and organizations that "qualify as a foreign equivalent of a public charity in the opinion of the Ford Foundation" are eligible for matching. See the guidelines for further provisos.

The "Frequently Asked Questions" page linked from here contains slightly more detailed information.

Organizations not on this list

Employees of the Intermec Foundation can match gifts up to $75K/year, but due to an acquisition by Honeywell, new employees are not eligible. Also, the allowed donation targets for matching seem somewhat strict: "The Foundation focuses on educational, food banks, art and cultural programs, health and wellness organizations and on occasion, community relief causes. [...] Organizations receiving donations must have a significant connection to eligible donors or the communities in which Intermec had a significant presence." See also the page on Double the Donation.

This article has a nice list of matching programs whose limits are $50K and below.

See also

- "How to double your donations with no extra effort"

- "Top Matching Gift Companies" (unfortunately, many of these top-matching companies actually have pretty low match limits)

Acknowledgments

Thanks to Joey Savoie for providing some data underlying this piece. Feel free to contact him for the data. Skyler Lehto pointed me to the Ford Foundation's matching program.