Summary

For large, highly scalable charities, donors should be roughly risk-neutral and should not diversify their donations. For small, start-up charities, the exact opposite is true. This is because of diminishing marginal returns to wealth at a small scale and because of the learning value of investing in multiple projects.

Contents

- Summary

- Altruistic risk neutrality

- Why risk neutrality is never completely true

- When altruists should be financially risk-averse

- Diversification for learning

- If you diversify charities, are you still risk-averse with respect to wealth?

- It's hard to spend $1 billion well

- If you're already rich, focus on spending, not earning

- Using money for influence

- Money is less valuable in richer worlds

- Great donation opportunities may be temporary

- Taxes and donation matching

- Altruists should diversify when possible

- Footnotes

Altruistic risk neutrality

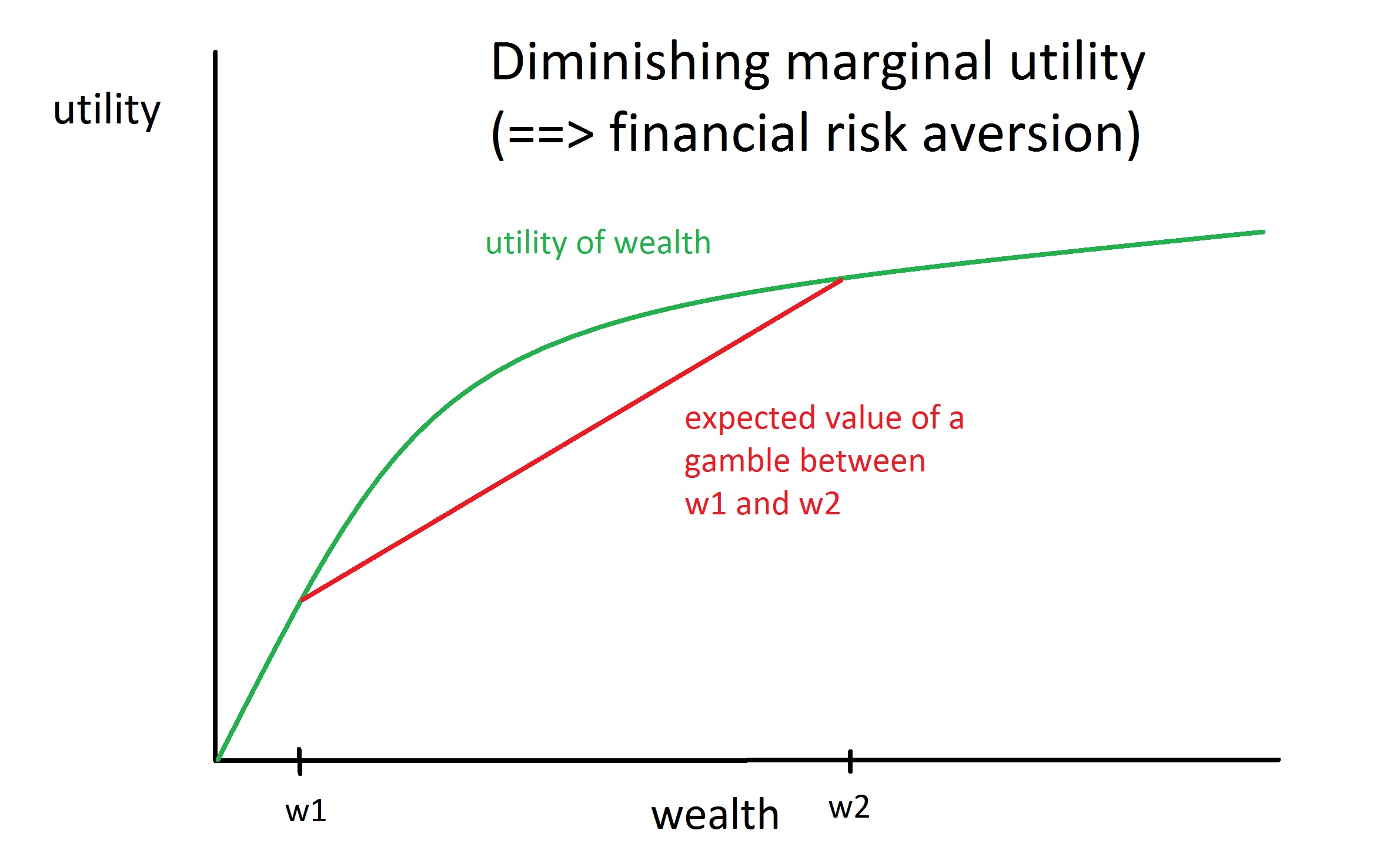

Individuals are financially risk-averse because of diminishing marginal utility of wealth: Making sure your basic needs are satisfied is more important than a long-shot bet for a second mansion.

Usually people carry over this risk-aversion to the charitable realm: They want to make sure they have some impact, but they become scope insensitive with respect to exactly how much impact is made.

Effective altruists often see why altruistic risk-aversion doesn't make sense: If you're trying to actually help as much as possible, then sparing ten animals from suffering is actually ten times as good as sparing one, even if the dopamine release in the donor's brain is not ten times as high.

One implication of risk neutrality is that altruists can take riskier careers than others are willing to entertain, which allows them to squeeze out excess expected returns resulting from risk premia. In an old essay, "The Case for Risky Investments," I argued on similar grounds that altruists should invest in capital-market instruments with higher systematic risk than most people are willing to purchase, again in order to go for higher expected value along with (irrelevantly) higher variance. As an empirical matter, higher-beta stocks may actually give lower average returns—see, e.g., Figures 1 and 2 of "Re-Thinking Risk: What the Beta Puzzle Tells Us about Investing" by David Cowan and Sam Wilderman. Still, this doesn't detract from the theoretical point at hand, when it does hold in practice.

A second implication is that altruists should donate to just one charity: whichever one has the highest expected value. Many donors prefer to "diversify their portfolio" of charitable donations, but this necessarily decreases expected value unless two or more charities accomplish exactly equal expected good per dollar.

Why risk neutrality is never completely true

The above points are interesting and important observations against standard donor intuition. However, in practice they both have some problems. They assume that an extra $1 buys an equal extra number of saved animals regardless of how many dollars are donated. This may be roughly correct in some cases. For example, Vegan Outreach has a budget of ~$1 million, so additional donations on the order of a few hundred thousand dollars or less would probably have basically linear expected value for animals. Even in this case, the marginal value of money decreases as the best schools are leafleted, leaving less good schools among the remaining pool. In addition, Vegan Outreach presumably hired the best people with its first dollars, so additional dollars will mean hiring other staff who aren't quite as dedicated.

Similarly, for, say, Oxfam donations, the first dollars will go to the more important projects and will hire the most important staff, with diminishing returns thereafter. Still, when the scale of the charity is really vast, probably the decreasing marginal value of money becomes less significant, unless you're making a long-shot gamble for hundreds of millions of dollars or more.

When altruists should be financially risk-averse

The dynamics are different when we consider small, startup charities. In this case, the first seed money can be vastly more important than incremental donations, because it determines whether the project gets off the ground and has a chance of becoming self-sustaining. Similarly, the first few employees of a startup may be vastly more qualified than the additional staff that could be brought on, implying that the marginal value of additional funds may diminish rapidly. Finally, even the project that the startup is aiming to tackle may have diminishing returns: If, rather than helping incremental animals, the project aims to research important issues in effective altruism and cause selection, there may be intrinsically less value the longer the project goes, even if the incremental employees are no less qualified.

If the startup has only a few funders willing to contribute, then risk aversion becomes rational, since it's very important to make sure the startup has enough funding to take off. Even if it got a windfall of millions of dollars right away, it would take a long time for it to scale up; charities can't grow instantly, or even necessarily quickly. Stability of funding is important for small organizations.

If there are many possible funders of the startup, then risk aversion is less important, because the law of large numbers implies that at least one or a few of the potential donors will probably make it big.

Diversification for learning

Diminishing value of wealth for small charities is one reason a big donor should diversify: The charity with the highest expected value for its first $1 may not be the charity with the highest marginal $1 after you've already donated $100K.

There's another reason to diversify, which is to learn: Try out lots of charity startups and see which ones work best. This is a superior alternative to hoping you can, a priori, presage which project will be most successful and donate exclusively thereto. Standard explore-vs.-exploit algorithms involve a randomization component, where you deliberately try levers that seem less good in order to learn for the future, just in case they were better than you thought. In the same way, attempting many efforts in the altruistic landscape has higher long-term value than simply exploiting whatever single idea looks the best. When there's a significant feedback dynamic to your donations and not just a "give and hope it works" situation, some contributions to seemingly suboptimal causes may be the best course of action.

If you diversify charities, are you still risk-averse with respect to wealth?

There are many good startup charities in the world, doing lots of important work. If you donated seed money to lots of them at once, wouldn't this provide roughly linear returns on wealth, since no individual one of them would hit sharp diminishing returns? In theory, maybe. After all, it's not as though the world is likely to contain a few really low-hanging altruistic fruit waiting to be plucked, and this means that the many more higher-hanging fruit are probably not too far apart from each other in value. However, in practice, I expect that getting near-linear returns by donating to lots of startups at once would not likely be feasible.

The reason is that, if you're donating millions of dollars, you have to find all those tens or hundreds of super-effective startup charities. It's hard enough to identify one or two that you think are stellar in their performance; to find many times more and be equally sure of their value is not easy. In practice, this means that your confidence in any particular one is lower than it would be if you donated a small amount and had more time to explore your donation target. Hence the average expected value of your donations is lower when you have more of them to make, again implying diminishing marginal value for wealth.

You could aim to circumvent this problem by starting your own foundation and tasking others to research the charities for you. This is a good option, but it remains the case that the foundation staff will choose projects slightly different from what you would have wanted, implying less value to you specifically.

The same situation would obtain if you used an external charity evaluator to pick the tens/hundreds of startups you'd be funding. In this case, we can squint and regard this collection as being like a big charity (under the umbrella of the charity evaluator), in which case this arrangement reduces to the rough risk-neutrality of donating to really large organizations.

It's hard to spend $1 billion well

If I got $1 billion right now, I would have a really hard time spending it well. It already has taken me years to identify some charities with ~$1 million annual budgets that I think have exceptional quality relative to my values. If I had to identify hundreds of such charities, I might never finish in my lifetime. I could dictate some high-level goals for my foundation, but my specific goals would inevitably degrade to some extent as other people made different decisions than I would have and as the selection criteria became increasingly less rigorous. Many big foundations give grants to a wide array of projects, some of which may be far cries from what the original donor had in mind.

It's common for applicants for foundation grants to think: "How can I spin my current project to make it seem like something that appeals to this foundation's goals?" Of course, hopefully if the project is spun too far, it'll be rejected, but many suboptimal projects probably get approved by large foundations. Moreover, if someone was already very passionate about a given project, s/he might have gotten funding from elsewhere, so the marginal contribution of your donations might have been small. In contrast, it's easier to fund genuine projects that wouldn't have happened anyway if you're involved enough with the people you fund on a personal level to know what's actually going on.

Given this, I would guess that $1 billion would be not more than ~300 to ~500 times as valuable as $1 million. Moreover, insofar as the quality of a billionaire's donations degrades toward the mean, her donations may not be substantially more valuable than those of some other potential billionaire who would have gotten rich in her place had she not founded the lucrative startup first.

If you're already rich, focus on spending, not earning

After decades at Microsoft, Bill Gates "announced in June 2006 that he would begin transitioning out of his day-to-day role to dedicate more time to philanthropy. [...] He finally retired as chief software architect in June 2008". Given that Gates could have continued earning millions or tens of millions of dollars per year as Microsoft's CEO, was this a wise move?

In 2016, Gates has a net worth of ~$79 billion. In 2015, Microsoft CEO Satya Nadella earned $18.3 million. Suppose Gates could have earned that amount per year as well.

If Gates was no better at donating his money according to his values than the next-best person, then he should have continued as CEO and let someone else donate his existing wealth. But if he was even slightly more skilled at directing his wealth in directions he preferred, then relative to Gates's own values, he should have quit to supervise the Gates Foundation, as he did. Even if his time spent on philanthropy improved the donation targets of the Gates Foundation by only 0.05% per year relative to his values, that was worth 0.0005 * ($79 billion) = $40 million per year.a

Of course, from an outsider's perspective, it's unclear that Gates's values and charity advice are better than those of a cheaper replacement. So it's less clear (though still possible) that third parties should be glad that Gates quit when he did.

In general, this kind of calculation suggests that if you want to optimize your personal values, you should probably focus on philanthropy in the event that you become extremely wealthy, such as a by founding a billion-dollar company. Of course, success at startups is not random, so you'd probably be better at founding another startup than most other people. But unless this effect is extremely strong, or unless you have unusually few non-mainstream opinions about morality, then managing your existing wealth is probably better.

Maybe this is part of the reason why GiveWell tends to think that talent gaps are more significant than funding gaps: In some sense, they already "have" almost $8.3 billion from Dustin Moskovitz—or at least, they play a crucial role in spending that sum. So additional work identifying how to best spend that wealth is quite important for them.

Using money for influence

One benefit of donating to a charity is the opportunity to shape what it works on—through earmarking, friendly requests, or joining the board of directors. Influence requires time to get to know the charity in some depth. If you have too much money, you won't have the bandwidth to influence all the charities to which you donate as much per dollar donated as if you had less money.

On the other hand, there may be cases where influence has increasing returns to wealth. For example, Mark Zuckerberg, Elon Musk, and Bill Gates are always in the news, which gives them big megaphones. In contrast, ordinary millionaires are rarely newsworthy by default. That said, millionaires can get in the news through various activities they undertake, and given that a single person only has so many hours in a day, some millionaires can get more news exposure per dollar of net worth than Bill Gates can.

Money is less valuable in richer worlds

In "Risk aversion and investment (for altruists)", Paul Christiano notes that because charitable giving is highly correlated with overall wealth, charities will tend to have a surplus of money when the stock market does well and a deficit of money when the stock market does poorly. As a real-world demonstration of this point, see the chart on this page, showing how Vegan Outreach's donations and booklet distributions were impacted by the 2008 financial collapse. Likewise, in Lifecycle Investing (p. 113), the authors report that "In 2008-2009, donations to Yale fell by 28 percent while the market fell by 38 percent. [...] Over at MIT, individual donations fell by 32 percent in 2008-2009."

This suggests a degree of risk aversion because a given dollar makes a bigger impact if worldwide investments perform badly than if they perform well. As an example, suppose a charity reduces 1 unit of suffering for every dollar donated below $100 million and 0.9 units of suffering for every dollar donated above $100 million. The charity is currently at $110 million, so no matter how much or little you donate, the marginal value of dollars is the same: 0.9 units/$. But now the stock market takes a nosedive, and the charity has only $90 million. Now your donations are more valuable per dollar (1.0 units/$)—not because your donations by themselves are sufficient to produce diminishing returns, but rather because the value of dollars is somewhat negatively correlated with overall market performance.

That said, I doubt the effect is huge, since the decline in a charity's marginal value as a function of its wealth should be much less dramatic than the decline in an individual's marginal happiness as a function of her personal wealth. In other words, altruists should still be much more risk-neutral than most investors.

One other suggestion that derives from considering wealth correlations is that if most other donors to your cause are in your own continent, then they'll have non-stock-market wealth tied up in assets in that continent. Therefore, insofar as that continent's stock returns correlate with its non-stock-market wealth, it's slightly better to invest in foreign stocks than domestic stocks to reduce the correlation between your returns and the wealth of other donors.

Great donation opportunities may be temporary

Sometimes a charity needs money urgently to avoid cutting staff or shutting down altogether. Other times a person may want to start a nonprofit now or never. In cases like these, it's helpful to have money right away that you can donate. If you put all your eggs in the basket of a highly risky money-making venture/investment that may or may not pay out eventually, it's harder for you to make urgent donations.

That said, probably having a few hundred thousand dollars of emergency savings would be enough to cover instances where donating right away is important. You probably want that much in emergency savings anyway for personal reasons. After that point, it can make more sense to shoot for more speculative gambles for greater amounts of wealth.

Taxes and donation matching

In the US, it's best if you can donate at least 50% of your income per year in order to max out charitable deductions. If the money you plan to donate is invested in such a risky way that it may fall to a low amount, such that you can't donate at least 50% of your income in some year, that's disadvantageous. This isn't very likely, though.

A similar point applies for a company donation-matching program, especially if the max donation match is very high, such as at Soros Fund Management.

Altruists should diversify when possible

Suppose two altruists are considering joining early-stage startups. Should they work at the same startup or at separate ones? Unless the two people have excellent synergy, they should work at separate startups so that they aren't putting all their eggs in one basket. For example, suppose that each startup has a 3% chance of success, and if it succeeds, it pays off $10 million to the altruist. If the value of additional money declines pretty sharply after $10 million, then what mainly matters is whether one of the two altruists hits a home run. That probability is roughly doubled if they work on separate startups (especially if those startups are uncorrelated, such as by being in different industries).

Footnotes

- To see this, note that the impact of donations is the product of average cost-effectiveness C and amount donated D: total impact = C * D. Improving average cost-effectiveness by 0.05% means C becomes 1.0005 * C. Total impact is then 1.0005 * C * D. This is as good as C * (1.0005 * D), i.e., increasing the total amount donated by 0.05% at the baseline level of cost-effectiveness. (back)